State Bank of Pakistan cuts key policy rate for sixth consecutive time

5 min readSBP’s outlook

- Average inflation is expected to hover between 5.5% to 7.5% in Fiscal Year July 2024 – June 2025

- Current account deficit/surplus level is expected to be from 0.5% deficit to 0.5% surplus

- GDP rate is assessed to range from 2.5% to 3.5% for current fiscal year

- Reserves would by over $13 billion by the end of June 2025

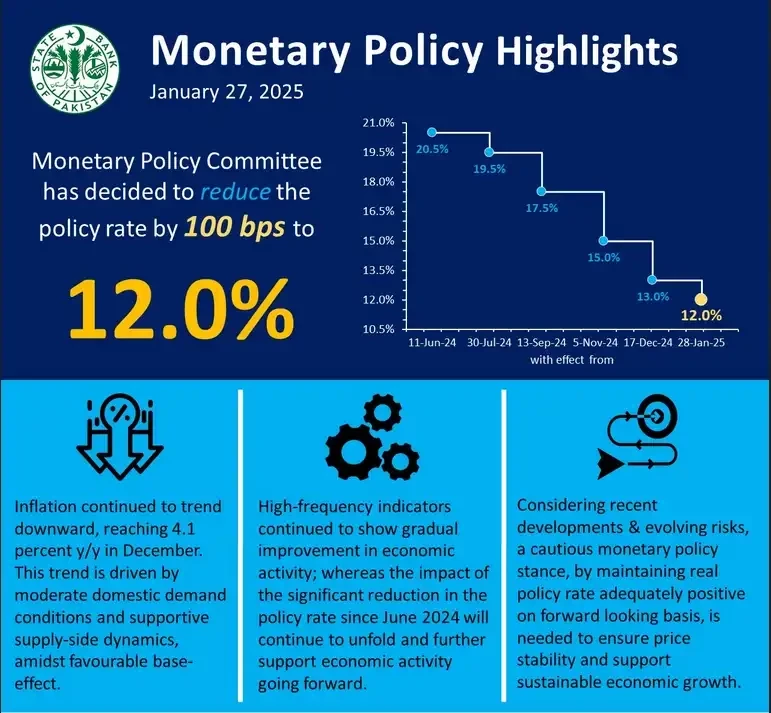

The State Bank of Pakistan announced a new monetary policy on Monday, as the committee cut the policy rate by 100 bps to 12 per cent.

“The Monetary Policy Committee after a detailed discussion has decided to bring down the policy rate from 13 per cent to 12%,” SBP Governor Jameel Ahmed said while addressing a press conference in Karachi.

“In other words, a 100 basis points reduction was decided in today’s meeting.”

The central bank governor attributed the fall in interest rate to “positive” economic indicators, including the pace of inflation, current and external account issues.

The central bank governor also noted that inflation is projected to be at 4.1 per cent by December 2024. In a “positive development,” the current account deficit for December 2024 has turned into a surplus of $582 million.

For the first six months of the current year, the current account deficit was reported at $1.021 billion, according to the SBP governor. The country’s total foreign exchange reserves are currently at $16.19 billion, as highlighted by the SBP.

Inflation is expected to come down further in January before inching up in the subsequent months, according to Ahmed.

The committee also noted that core inflation, while continuing to ease, was at an elevated level. “At the same time, high frequency indicators continued to show gradual improvement in economic activity. The MPC assessed that the impact of the significant reduction by 1,000 bps in the policy rate since June 2024 will continue to unfold and further support economic activity.”

The committee noted that real GDP growth in quarter one-FY25 turned out slightly lower than the MPC’s earlier expectations. Secondly, the current account remained in surplus in December 2024, though the SBP’s FX reserves declined amidst low financial inflows and high debt repayments.

Despite a substantial increase in December, it added that tax revenues remained below target in H1-FY25. Global oil prices have exhibited “heightened volatility” over the past few weeks. The global economic policy environment has “become more uncertain, prompting central banks to adopt a cautious approach.”

Given such a situation, the committee viewed that a “cautious monetary policy stance” was needed to ensure price stability, which is essential for sustainable economic growth. The committee assessed that the real policy rate needed to remain adequately positive on a forward-looking basis to stabilize inflation in the target range of 5 to 7 per cent.

He went on to add that the growth rate in the first quarter could have been over two per cent, as per the SBP’s expectation, if the agriculture growth had been to a level near to last year.

“We have decreased the policy rate by 10% in the last six to seven months. It was 22% and now has fallen down to 12%,” Ahmed said and added that its impact was gradually being seen in the economy.

Real sector

The MPC noted that the downtrend in large scale manufacturing – which has been pulling down industrial growth – has been driven by a few low-weight items, such as furniture.

In contrast, key industrial sectors – such as textile, food and beverages, and automobiles – have shown noticeable improvement. Moreover, the business confidence index has continued to show positive sentiments.

Going forward, the MPC has expected economic activity to gain further traction and real GDP growth to remain in the earlier projected range of 2.5 – 3.5 per cent.

External sector

Driven by remittances and export earnings, the current account posted a surplus of $0.6 billion in December, bringing the cumulative surplus to $1.2 billion during H1-FY25.

The outlook for the current account balance has improved considerably and is now expected to remain between a surplus and a deficit of 0.5 percent of GDP in FY25. Meanwhile, net financial inflows, though tepid during H1-FY25, are expected to improve going forward as a sizable part of official debt repayments has already been made. Consequently, the improved current account outlook, along with the expected realisation of planned financial inflows, is likely to increase the SBP’s FX reserves beyond $13 billion by June 2025

Fiscal sector

The Federal Board of Revenue revenues recorded a notable increase of around 26 per cent during H1-FY25, however, the shortfall in tax collection from the target has widened.

The committee viewed that the anticipated lower interest payments than the budgeted amount are likely to contain the overall fiscal deficit around its target. “However, achieving the target for the primary balance would be challenging.”

Money and credit

The broad money (M2) growth decelerated further to 11.3 per cent y/y as on January 17, compared to 13.3 per cent at the time of the last MPC meeting. The decline in M2 growth came primarily on account of a significant deceleration in the NDA growth.

“While the government’s borrowing from the banking system remained relatively contained and shifted to non-bank sources, banks’ credit to the private sector grew sharply. This was mainly on account of the ongoing economic recovery, ease in financial conditions, and aggressive efforts by banks to meet the advances to deposit ratio thresholds.”

Also, read this

Shabbar Zaidi calls for ending ‘supremacy of one province’ to improve NFC Award

Economist Atif Mian laments increasing hopelessness on Pakistan streets

Inflation

Headline inflation remained on its downward trajectory and eased to 4.1 per cent y/y in December from 4.9 per cent in November.

“The declining trend in inflation is mainly led by the downward adjustment in electricity tariffs; adequate supply of key food items leading to low level of food inflation; stability in exchange rate; and favorable base effect.”

The MPC reiterated its earlier assessment that the near-term inflation woulc remain volatile and is expected to increase close to the upper bound of the target range towards the end of FY25.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.