Wealth managers ramp up staff in Hong Kong to chase Chinese demand

3 min readHONG KONG: Wealth management firms are expanding operations aggressively in Hong Kong to meet pent-up demand from rich Chinese individuals looking to invest more money overseas after three years of COVID-19 curbs, industry sources said.

High- and ultra-high net worth families in China are seeking to diversify their investments as they are finally able to travel and as they chase alternatives to a depressed property market at home.

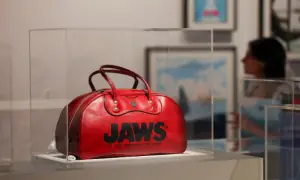

This week has been exceptionally busy, sources said, with mainland visitors flocking to the first Art Basel fair in Hong Kong since China’s COVID-19 curbs were lifted.

“Reopening means robust growth in our international business. Client inquiries for offshore investment increased 155% in the first quarter year on year,” Oscar Liu, CEO of the wealth management department at Noah International told Reuters.

Noah Holdings, the largest independent wealth management firm in China, was among five private banks and wealth management firms Reuters talked to that said they held client events in the city and organised private art tours.

They are chasing some of China’s 2.1 million “high net wealth” families, each with net worth more than 10 million yuan ($1.46 million), and 138,000 ultra-high net worth families with over 100 million yuan as of January 2022, according to data from Hurun Research Institute published this month.

Offshore investment enquiries jumped by a third in March over the previous month, Liu said.

Shanghai-based Noah, which manages $22 billion in assets, plans to expand its front office in Hong Kong five-fold from about 20 to 100 relationship managers in 2023, hiring locally and transferring personnel from mainland China.

The wealth manager’s expansion plan is apart from other middle and back office staffing. Liu said overseas business was expected to make up over 30% of Noah Holding’s total assets under management in 2023, up from 20% currently.

Hywin Holdings, another Chinese wealth manager, invited 30 ultra-high-net worth clients to workshops, fund manager visits and even a yacht party in Hong Kong last week.

Nick Xiao, Hywin International’s CEO, said the reopening had not only made it easier for wealthy Chinese investors to access global products, but had also revived interest in Hong Kong as a hub for financing, investment and a base for accessing mainland markets.

The firm intends to recruit up to 10 private bankers in 2023 and add staff in supporting roles, Xiao said.

Vying with Singapore

Dong, an investment banker in Shenzhen, plans to come to Hong Kong in the next few months to open a bank account and buy insurance products.

“Holding dollar assets provides a lot of flexibility. It can be used in the future to buy overseas property or to pay tuition for children studying abroad,” said Dong, who prefers to go by his family name.

To tap such rapidly growing demand from mainland investors, HSBC Bank launched a pilot program to keep three Hong Kong branches, including wealth management centres, open seven days a week.

The Hong Kong government, too, organised a Wealth for Good summit on Friday to attract global family offices to the city and away from Singapore, which had become the preferred destination for wealthy entrepreneurs during Hong Kong’s strict pandemic restrictions.

The government also issued a policy statement on Friday, emphasising new measures including tax cuts for family offices and establishment of art storage facilities to support “a vibrant ecosystem for global family offices and asset owners”.

Chinese financial institutions are vying for this growing wealth management business in Hong Kong.

Chinese Everbright Bank and Hua Xia Bank set up private banking departments in Hong Kong in the past few months, according to sources familiar with their plans.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.