Pakistan’s external position under significant stress: Moody’s

4 min readRevenue-raising measures will likely be among prior actions that the International Monetary Fund (IMF) requires before releasing the next tranche of financing to Pakistan, Moody’s Investors Service said in a statement on Friday.

Pakistan and the IMF will resume talks virtually next week after 10 days of face-to-face discussions in Islamabad on how to keep the country afloat ended without a deal.

The talks are aimed at unlocking at least $1.1 billion of stalled funding for the South Asian country.

“Pakistan’s government liquidity and external vulnerability risks are elevated, and there remains considerable risks around Pakistan’s ability to secure required financing to fully meet its needs for the next few years,” Moody’s said.

Prime Minister Shehbaz Sharif previously called the conditions for the $1.2 billion loan installment “beyond imagination”.

Finance Minister Ishaq Dar addressed the nation after the IMF team left the country on Friday morning, saying talks had “concluded successfully” and that a draft memorandum on broadly agreed policies had been shared by the lender with the government.

He said petrol prices would rise by roughly four per cent and additional taxes would be imposed, without giving further details.

Economic analyst Abid Hasan, a former adviser to the World Bank, said “there will be disappointment in the business community”.

“The only way stability can be achieved is through a deal. This has heightened the uncertainty,” he told AFP in the capital Islamabad.

‘So expensive’

Years of financial mismanagement and political instability have damaged Pakistan’s economy – exacerbated by a global energy crisis and devastating floods that submerged a third of the country.

After months of holding out in search of alternatives, the government began to bow to IMF pressure in mid-January, loosening controls on the rupee to rein in a rampant black market in US dollars – a step that caused the currency to plunge to a record low. Authorities also hiked petrol prices by 16 per cent.

Rana Sadiq, a 65-year-old real estate worker, has had to sell his car and commute on a motorbike to save money.

“Gas bills, electricity bills, petrol prices, fruit and vegetable prices have all doubled in the last few months,” he told AFP from a market in Islamabad.

“I can’t meet the monthly expenses. Before, my children used to eat fruit every day – now I take fruit home once in a week.”

Batool Zehra, who runs a baking business from home in Lahore to support her family, is struggling to make a profit as prices soar.

“The ingredients are so expensive now… and that’s if they are available. I have been unable to complete orders because half the time I realise there is no gas,” she told AFP.

“I don’t think I will be able to continue the business. But I also don’t know how my family is going to make ends meet without this extra income.”

Import backlog

On Thursday, the central bank released data saying its foreign exchange reserves had plunged by $170 million in a week, standing at just $2.9 billion as of last Friday.

Since January, the world’s fifth most populous nation is no longer issuing letters of credit, except for essential food and medicine, causing a backlog of raw material imports the country can no longer afford.

The logjam coupled with the rupee devaluation has sparked a major decline in manufacturing, including textiles and steel, and building projects.

“This situation has triggered fears the construction industry will close down very soon, plunging thousands of labourers into unemployment,” Syed Ashfaq Hussain, head of the Constructors Association of Pakistan, told AFP.

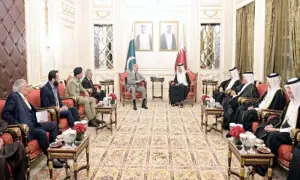

While the IMF cash injection will not be enough to rescue Pakistan on its own, the government hopes it will boost confidence and open the doors for friendly nations such as Saudi Arabia, China and the UAE to offer further loans.

“We will get temporary relief but it’s not a permanent solution for the economy. More reforms are needed at the government level,” a senior government official told AFP.

Pakistan has brokered and broken more than a dozen IMF deals in recent decades as parties renege on agreements that hurt their political survival.

Political analyst Michael Kugelman, director of the South Asia Institute at the Wilson Center in Washington, previously warned that “barring difficult, large-scale reforms, the next crisis could be just around the corner”.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.