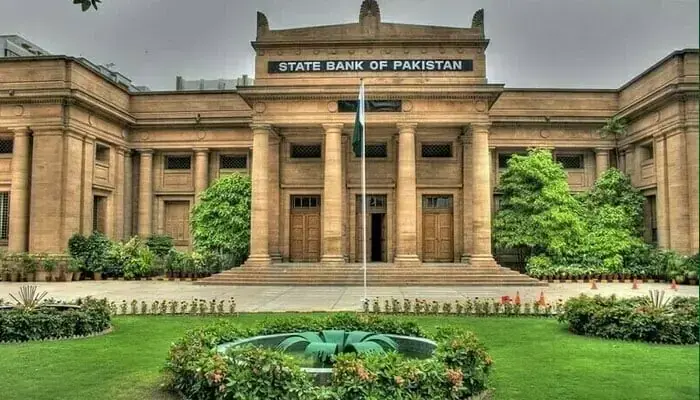

SBP holds policy rate at 10.5% in first 2026 MPC meeting

4 min readThe State Bank of Pakistan (SBP) decided on Monday to keep its benchmark policy interest rate unchanged at 10.5% in its first Monetary Policy Committee (MPC) meeting of 2026.

SBP Governor Jameel Ahmad announced the decision in a press conference.

Inflation in Pakistan could be above 7% in some months of the current year’s second half, he said.

The country’s gross domestic product (GDP) would grow by 3.75% to 4.75% this year, Ahmad envisaged.

At its previous meeting on December 15, 2025, the MPC had reduced the policy rate by 50 basis points (bps) to 10.5%.

Market experts had widely expected the central bank to further reduce the policy rate in today’s meeting on account of easing inflation, external stability and falling bond yields.

Arif Habib Limited (AHL) had anticipated that the SBP was likely to deliver a 75bps cut in the MPC, potentially taking the policy rate to 9.75%, “signalling a long-awaited return to single-digit territory”. However, the central bank decided to keep the policy rate unchanged.

Similarly, Topline Securities, another brokerage house, had also expected a rate cut, citing its recent survey, which showed that 80% of the participants were expecting a rate cut.

The brokerage house had attributed the shift in market perception to lower-than-expected inflation readings in the last two months, better than expected remittance flows, supporting external accounts, and largely stable PKR/USD parity.

Similarly, a Reuters poll had found that the central bank was expected to cut its key policy rate by 50bps, as easing inflation, improving foreign exchange buffers, and a stabilising rupee bolster the case for further monetary easing despite lingering risks.

Of the 10 analysts surveyed, seven had expected the SBP to cut rates by 50bps, two saw a deeper 75bps reduction, while one expected the central bank to hold rates unchanged.

Apart from analysts, business leaders also urged the government to bring the policy rate down to single digits, citing easing inflation.

In a statement, Saqib Fayyaz Magoon, Chairman of the Businessmen Panel Progressive (BMPP) and Senior Vice President of the Federation of Pakistan Chambers of Commerce & Industry (FPCCI), warned that persistently high borrowing and energy costs had been inflicting serious harm on industrial output and export competitiveness.

He said the government should capitalise on the improving inflation outlook to offer immediate relief to the business community by lowering the cost of financing.

Saqib stressed that the policy rate should be brought down to single digits without delay and called for a cut of at least 100bps, which he described as a long-standing demand of the business community.

Previous MPC meeting

In its last meeting, held on December 15, the MPC reduced the policy rate by 50bps.

Back then, the MPC, in its statement, noted that inflation, on average remained within the target range of 5–7% during July-November FY26, though core inflation was proving to be relatively sticky.

“On balance, the inflation outlook remains broadly unchanged, mainly owing to the relatively benign global commodity prices and anchored inflation expectations, amidst a prudent monetary policy stance.

“The committee also assessed that economic activity continues to gain traction, based on robust improvement in key high-frequency indicators, including a higher-than-anticipated increase in large-scale manufacturing in Q1- FY26,” read the statement then.

Since the last MPC meeting, several key economic developments had occurred.

The rupee appreciated by 0.16%, while petrol prices declined by 4%.

Internationally, oil prices rose by over 7% since the last MPC, hovering around $61 per barrel.

Pakistan’s headline inflation clocked in at 5.6% on a year-on-year (YoY) basis in December 2025, showed Pakistan Bureau of Statistics (PBS) data, a reading in line with the Ministry of Finance estimate of 5.5-6.5%.

In addition, Pakistan’s current account posted a deficit of $244 million in December 2025, data released by the SBP showed.

The deficit followed a surplus of $98 million recorded in November 2025, which was originally reported to be at $100 million, and a surplus of $454 million in December 2024.

The SBP held foreign exchange reserves increased by $16 million on a weekly basis, reaching $16.09 billion as of January 16, 2026. Total liquid foreign reserves of the country stood at $21.26 billion, while net foreign reserves held by commercial banks were recorded at $5.17 billion.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.