Fair tax contribution missing link to Pakistan’s progress

8 min readPakistan is a country with great potential. It is blessed with natural resources, has a young population, and sits in a strategic location in Asia.

Yet, despite these clear advantages, it continues to struggle with weak public services and poor infrastructure.

Roads are broken, hospitals lack proper facilities, schools are overcrowded, and clean drinking water remains unavailable to millions of people.

One of the main reasons for these problems is the lack of sufficient tax revenue. Far too many citizens, particularly those in powerful positions, do not pay their fair share of taxes.

Inaccurate tax filing by elites and wealthy groups has become a major obstacle to progress in the country.

The contribution of taxes is necessary for any nation. The government needs money to build and maintain roads, support public transport, provide clean water, run hospitals, and strengthen the education system.

Without proper tax collection, a country cannot function effectively. When people do not contribute fairly, the government becomes unable to provide essential services to its citizens.

In Pakistan, the burden of taxes often falls on those who are already struggling, such as salaried workers and lower-income families.

Meanwhile, wealthy individuals and large businesses find ways to avoid paying what they owe.

This creates an unfair system that favours the rich and harms ordinary people.

The belief that the tax system is unjust has become one of the biggest barriers to development.

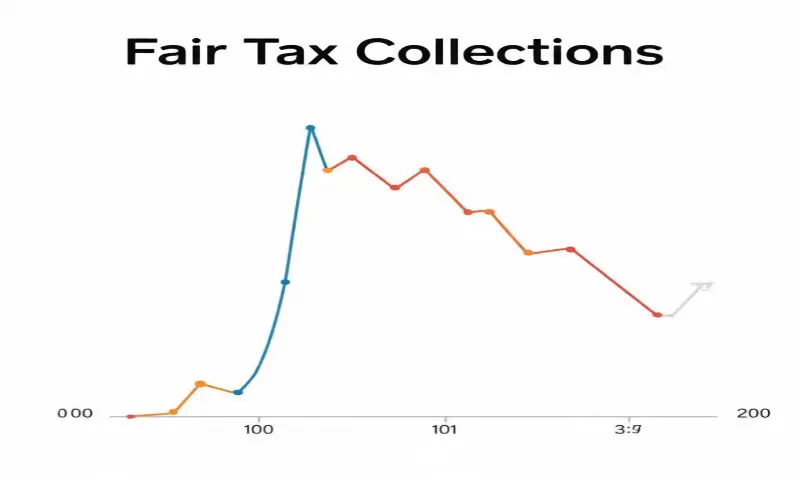

In the most recent fiscal year, Pakistan’s tax revenue showed some improvement. The government collected around Rs11.7 trillion, reflecting an increase of more than 25 per cent compared with the previous year.

Growth was seen across several areas, including sales tax, income tax and customs duties.

The tax-to-GDP ratio also improved and moved slightly above 10 per cent, one of the highest levels seen in recent years.

While these results show progress, they remain low when compared with many developing countries.

The government also failed to meet some of its own revenue targets, highlighting that much more work is needed before tax collection becomes strong enough to properly support the country.

Despite these gains, Pakistan continues to struggle with a very low tax base.

This means not enough people pay tax, and many who do pay far too little. As a result, the government finds it difficult to fund essential public services, and this affects everyday life across the country.

In many developed nations, paying taxes is seen as a duty and a shared responsibility.

Citizens understand that the money they contribute helps create better services and a stronger society.

In Pakistan, however, there is a lack of trust between citizens and the state.

Many people believe that the government wastes money through corruption, unnecessary spending and poor management.

Because of this, they do not feel motivated to pay taxes. Some do not file tax returns at all, while others hide their true income or use loopholes in the system to reduce the amount they must pay.

This behaviour results in a tax system that fails to provide the revenue needed for essential services.

As a result, Pakistan remains dependent on loans from other countries and international organisations.

Borrowing money may offer short-term relief, but it creates long-term problems.

Every loan must be repaid with interest, which increases the financial burden on future generations.

Instead of spending money on development projects, a large share of the national budget goes towards paying off debt.

This cycle continues because the country does not collect enough money from within its own economy.

The wealthy elite, including influential politicians, large business owners, landlords, and high-income professionals, play a major role in this issue.

Many rich individuals own luxury houses, expensive vehicles and vast properties, yet they report little or no taxable income.

Some make large profits but contribute only a small amount in tax, if anything at all.

It is deeply unfair that a low-paid employee or a small shopkeeper pays their dues while a wealthy landlord or powerful businessman contributes almost nothing.

Agriculture, a major sector of Pakistan’s economy, is largely controlled by powerful landlords.

Yet agricultural income is often exempt from tax or not properly recorded. This allows influential people to avoid paying what they owe, while smaller businesses and ordinary workers continue to carry the burden.

Corruption within tax departments makes the situation even worse. Some tax officials accept bribes or ignore false tax filings.

Citizens with strong political or economic connections use their influence to escape penalties.

This culture of corruption has weakened the entire tax system. Honest taxpayers feel discouraged when they see others cheating without consequences.

The message it sends is that paying tax is optional, especially for those with power.

The consequences of this weak tax system are visible everywhere in Pakistan.

Roads in major cities such as Karachi, Lahore and Islamabad are often damaged and unsafe.

Public transport remains limited and unreliable. These problems affect daily life as well as trade and investment.

Businesses face delays in transporting goods, which raises costs and reduces profit.

Poor infrastructure also discourages foreign investors who worry about logistics and safety.

Healthcare services suffer greatly, too. Many public hospitals lack enough doctors, nurses and equipment.

Patients wait for long hours to receive treatment, and some lose their lives because of delays and shortages.

With a stronger tax system, the government could invest more money in hospitals and clinics, improving healthcare in both urban and rural areas.

Education is another sector badly affected by low tax revenue. Government schools often have broken buildings, outdated furniture and too few teachers.

Children in such conditions struggle to compete with students in private institutions.

Education shapes the future of the nation, yet the current system widens the gap between the wealthy and the poor.

A fairer tax system would allow the government to improve school facilities and provide equal opportunities for every child.

Access to clean water and proper sanitation remains a challenge in many regions.

Old and damaged pipelines lead to contamination, causing water-borne diseases.

Without enough revenue, the government cannot replace old infrastructure or build new systems.

Poor sanitation places extra pressure on already weak hospitals, creating a cycle of health problems that could be prevented.

Pakistan’s ongoing electricity crisis is also linked to financial shortages.

Without enough funds to invest in modern power projects, load-shedding continues.

Factories cannot operate efficiently, student learning is disrupted, and economic growth slows down.

If taxes were collected fairly and spent wisely, Pakistan could explore renewable energy options, upgrade power distribution systems and reduce outages.

Government-funded social welfare programmes also suffer. Widows, disabled people and those living in poverty need support to survive, yet many do not receive timely help due to a lack of funds.

As inequality grows, frustration spreads throughout society.

To fix these issues, Pakistan must take bold steps to improve its tax system.

First, tax laws must be reformed to make the system fair and transparent. The rich should not be allowed to escape their responsibilities while the poor pay more than their share.

Loopholes must be closed, and digital technology should be used to reduce corruption.

When processes are automated, and data is stored securely, it becomes harder for dishonest practices to continue.

Second, citizens need to rebuild trust in the government. When people see real improvements in public services, they will be more willing to pay taxes.

The government must show that tax money is used responsibly. Regular public reports, strong accountability and strict action against corruption will help restore public confidence.

Third, awareness campaigns are necessary to educate people about the importance of paying taxes.

Schools, universities and the media can help spread this message. When people understand how tax contributions improve daily life, they become more cooperative.

Fourth, penalties for tax evasion must be enforced equally. Anyone who avoids paying tax should face serious consequences, no matter how powerful they are.

Fairness in the legal system will encourage greater compliance.

Finally, political leaders must set the best example. When those in power pay their taxes honestly and on time, it encourages others to do the same.

Leadership means taking responsibility and demonstrating integrity.

Pakistan is still a young nation with a growing population full of hope.

The potential for strong development exists, but progress cannot be achieved without financial strength.

Every citizen has an important role to play, and paying taxes is one of the most meaningful contributions anyone can make.

Inaccurate tax filing by elites is not just a financial crime, it is a betrayal of the nation.

It keeps Pakistan trapped in a cycle of debt, weak infrastructure and poverty.

While the wealthy enjoy comfortable lifestyles, ordinary citizens suffer the most from broken roads, poor hospitals, weak schools and unsafe water.

It is time for a change. Pakistan needs a tax system where everyone contributes fairly, corruption is reduced, and public money is used wisely.

With commitment, honesty and a shared sense of responsibility, Pakistan can build strong infrastructure, improve public services and create a better life for all.

The path to progress may not be easy, but it begins with a simple step of paying taxes honestly.

When citizens fulfil their duty, the nation becomes stronger.

Pakistan’s future depends on the willingness of its people, especially its elites, to support their country through fair tax contribution.

Only then can Pakistan break free from its current challenges and move confidently towards a brighter and more prosperous future.

The writer is a seasoned journalist and a communications professional.

He can be reached at [email protected]

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.