FBR makes firm statement on deadline for filing returns

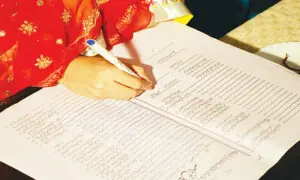

1 min readThe Federal Board of Revenue (FBR) has reiterated that the deadline for filing income tax returns will not be extended, urging all taxpayers to submit their returns by September 30.

The FBR is prepared to take strict action against individuals and businesses who fail to comply.

Despite a significant increase in tax compliance, with over 1.9 million returns filed so far and a surge in new registrations, the FBR remains committed to expanding the tax net. The agency is focusing on individuals and businesses operating outside the formal economy.

To ensure compliance, the FBR has outlined several consequences for non-filers. These include potential disconnection of mobile phone SIMs, electricity, or gas connections, freezing of bank accounts, and legal action.

The FBR has clarified that individuals with annual income exceeding Rs600,000, property or vehicle owners, and entrepreneurs earning above a specified threshold are all required to file their returns.

Read more:

Govt planning mini budget to squeeze on non-filers

Govt bends to please non-filers over proposed restrictions

FBR to impose heavy fines on large retailers for issuing non-certified receipts

The FBR’s data indicates positive trends in tax compliance, with around six million returns filed in 2023.

However, the agency is determined to broaden the tax base and ensure that all eligible individuals and businesses contribute their fair share.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.