Gender-inclusive fintech raises $3m to empower Pakistani women

3 min readOraan, a Karachi-based gender-inclusive fintech, has raised $3 million in the largest seed funding closed by a local women-led startup, according to a report by Dawn.

The report quoting a press statement issued by the company read: The investment was co-led by Zayn Capital and Wavemaker Partners, while other participants included Resolution Ventures, i2i Ventures, Hustle Fund, Haitou Global, Plug and Play, and angels like Claire Diaz-Ortiz.

Earlier, the fintech had raised financing from Tharros, Zayn Capital, an angel syndicate led by Google executives, and Graph Ventures, bringing its total funding raised to date to just over $4m.

Halima Iqbal, a former investment banker, and Farwah Tapal, a design strategist, founded Oraan in 2018.

“Oraan was founded when we realised that the large majority of the Pakistani population struggles to access financial services simply because they are not designed for them,” said Iqbal. “While there is a demand among women for credit, insurance and savings services, they are unable to approach financial institutions due to mistrust, complexity of products and challenges around mobility.”

According to the report, the startup has designed products and services around credit, insurance, and savings in Pakistan, which according to the company is home to five per cent of the world’s unbanked female population.

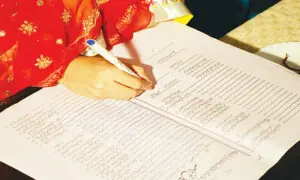

The statement described Oraan Committees, the startup’s flagship product, as the digital reimagination of Rotating Saving and Credit Associations (ROSCAs) — an age-old method of group saving and credit, read the report.

"ROSCAs, usually known as committees or beesees in Pakistan, are used by 41 per cent of the Pakistani population, with up to $5 billion rotating annually," it said, explaining that using the Oraan app, users could sign up for committees that suited their needs and allowed them to save with groups beyond their immediate geographical and social networks.

Recently, Oraan was selected for the Securities and Exchange Commission’s Regulatory Sandbox programme, the report said quoting the press statement, adding that today, Oraan boasted a community of over 10,000 savers, 84pc of whom were women, from across 170-plus cities.

"These women use Oraan Committees to save, borrow, build emergency funds, and achieve other goals like travel and pay for education, working capital, as well as medical treatments."

The statement added that the startup now planned to use its knowledge to launch other financial products especially catering to women "in the hopes of becoming the country’s women-first digital, social bank".

Lauding the company's funding, former special assistant to prime minister Tania Airdus termed it a "big milestone for women in tech and entrepreneurship" and for millions who have been financially excluded.

Federal Minister for Planning, Development, Reforms and Initiatives Asad Umar in a tweet said the initiatives like Oraan would make a great impact on key strategic objectives like women empowerment and increasing savings rate.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.