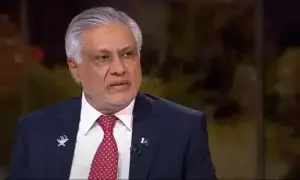

Budget 2016-17

Photo: FILE

Photo: FILEKEY MEASURES: On the back of achieving stability in the Macro Economic Framework, the Budget Speech, perhaps rightly, began with claiming that the economy is on track with all macroeconomic indicators confirming good performance. The reference to setting up of such macroeconomic targets in the manifesto and achieving these in three years is again a justifiable claim based on the following:

-- GDP growth of 4.71%; the highest in last 8 years. It was forcefully asserted that had there not been 28% losses in cotton crop, the GDP growth might have been higher by another 0.5%.

-- Increase in per capita income from US $1,334 in 2012-13 to US $1,561 in 2015-16.

-- Inflation at 2.82% during 2015-16; a 10 year record.

-- 60% increase in tax collection in 3 years; with total tax collections expected to surpass Rupees 3 trillion.

-- Tax to GDP ratio improving to 10.5%.

-- Fiscal deficit, albeit including provincial surpluses, held at 4.3%.

-- 40 year record low State Bank of Pakistan policy rate at 5.75%.

-- Exchange rate held stable for 3 years which is currently at US $1= Rupees 104.70.

-- Pakistan Stock Exchange Index at an all-time high, crossing 37000.

-- And the indicator which the Finance Minister is most passionate about, Foreign Exchange Reserves at a record US $21.6 billion.

While, arguably, the above claims can be subjected to substantive micro critique encompassing data errors, unpaid circular debt, luck, declining oil and commodity prices, rather than policy, all of which the opposition is expected to raise, however, criticism for its own sake is an exercise in futility. All in all, it is acknowledged that the Government since it came to power has made strenuous efforts to stabilise the economy and deserves all credit for positively converting international and domestic views about the state of the Country''s economy.

Going forward the Government has set even more challenging Medium Term Macroeconomic Targets to be achieved till 2018-19:

=============================== GDP growth 7% Inflation Single digit Investment 21% Fiscal deficit-clean 3.5% Tax-to-GDP ratio 14% ===============================

Forex reserves US $30 billion

The biggest obstacles to these rather ambitious targets are:

-- declining exports with an ever increasing Trade deficit of US $20 billion in ten months;

-- declining growth rate of workers'' remittances which at US $16 billion in ten months were instrumental in achieving economic stability;

-- total national debt and liabilities at Rupees 22 trillion with national foreign debt surpassing US $69 billion; and

-- very low investment rate of 15%

In order to address impediments to development, the Government''s three tier, out of the box, strategy is:

-- to invest more in infrastructure development;

-- provide incentives to the agricultural and industrial sector; and

-- to focus on poverty alleviation.

Within infrastructure the Government proposes to increase the PSDP to Rupees 800 billion as compared with Rupees 661 billion this year with a focus on motorways and Gwadar. Railways got a special mention, with an allocation of Rupees 78 billion. Diamer Bhasha and Dasu Dams were also allocated funding, but considering the forecasts regarding water stress, this may not be enough. Surprisingly while CPEC was mentioned as a game changer, its share in the budget speech was less than minimal.

It is refreshing that the government is focusing attention on agriculture and industry, with incentives ranging from cheaper financing, zero rating in sales tax, subsiding electricity, technology upgrading fund, early payment of tax refunds and duty free imports. However most of these incentives have been carried forward from last year, and which apparently did not foster the desired results. Ultimately, industrial growth and increase in exports are the biggest challenge for Pakistan, and will require constant monitoring with perhaps direct public investment.

The flip side of the above incentives is the policy to increase regressive taxation to fund sectors represented by strong lobbies; reverse redistribution. The middle class paying for the rich class.

On the other hand, the Government''s initiatives to alleviate poverty are applauded, especially in the case of BISP with a caveat that the program should eventually move towards encouraging self-sustainability within the targeted beneficiaries.

Improving macroeconomic stability was indeed a difficult task, the path to real development is tougher. The Government is moving in the right direction but will need to maintain a focused approach.

INCOME TAX

-- The Bill proposes to give exemption from all income taxes, including on dividend, to specific Chinese companies and their contractors and subcontractors, domestic or otherwise, operating at Gawadar Port for a period of 23 years commencing from 6th February 2007. In addition it is proposed that businesses operating in the Gawadar Free Zone would also be given tax exemption for 23 years commencing from 1st July 2016. This exemption across the board may perhaps be detrimental to the objective of documenting the economy.

-- Super Tax, levied for the tax year 2015 as a onetime tax, has now been extended and will be levied for tax year 2016 as well on the same basis; 4% on banking companies and 3% on other companies whose income exceeds Rupees 500 million. Further, it is proposed to exclude business losses and depreciation from the definition of income for the purposes of Super Tax. This particular amendment attempts to address the disputes arising in 2016 of adjusting brought forward business losses and unabsorbed depreciation for determining income subject to Super Tax. Furthermore, minimum tax under section 113 of the Ordinance will also apply in addition to Super Tax.

-- The Bill proposes to introduce a separate tax regime for Developers of plots and Builders of residential, commercial and other buildings, whereby tax is proposed to be charged on the basis of geography and size of plot. The intent is perhaps to provide an incentive to the sector, since the maximum rate of tax for a 500 Sq. Yd. residential plot is proposed to be Rupees 35,000, notwithstanding the current price of property in prime urban areas. While there is a need to incentivize the Housing Sector, linking taxes with area will necessarily result in taxes being passed on to the ultimate buyers. Nonetheless, FBR will be making Rules for implementation of this regime.

-- The Bill proposes to treat rental income in case of Individuals and Association of Persons as a separate block and to be taxed at rates ranging from 5% to 20%, with rentals below Rupees 200,000 to be exempt from tax.

-- Where taxes have not been withheld by a payer, the bill now purposes to treat all such expenses as inadmissible in case of the payer. However, on a positive note the disallowance in the case of raw materials and finished goods is being caped at 20%, and in case such withholding taxes have already been recovered by the tax authorities, presumably from either the payer or the recipient, expenses will not be disallowed.

-- The Bill proposes to restrict admissibility of expenses related to sales promotion, advertisement and publicity in case of pharmaceutical manufacturers to 5% of turnover.

-- The benefit of group relief is proposed to be restricted to percentage of holding of the parent company in the subsidiary company. Presently, the subsidiary may surrender all its assessed losses to the parent company holding at least 75% shares in case of an unlisted company and 55% in case of a listed company. The exemption from inter-corporate dividend for companies exercising group relief is also being withdrawn.

-- It is proposed to allow tax credit at average rate of tax on premiums paid for health insurance, upto Rupees 100,000 or 5% of income whichever is lower. This provision already exists for life insurance premium.

-- It is also proposed to allow a deduction against income on account of children''s education fees to parents earning upto Rupees 1 million in a year; restricted to lower of either 5% of the fee, 25% of income or at Rupees 60,000 per child. Ironically, the employer is not permitted to give this tax credit to an employee when withholding tax from salaries.

-- Tax credit for employment generation proposed to be extended to industries set up by 30 June 2019, as it was set to expire on 30 June 2018. In addition, tax credit for balancing, modernisation and replacement of plant and machinery is being extended to investments up to 30 June 2019; this credit was ending on 30 June 2016.Finally the exemption on income from export of software and IT enabled services also being extended to 2019 subject to the proviso that 80% of proceeds will be remitted through banking channels.

-- The limit of 100% equity for claiming 100% tax credit in case of newly established industrial undertakings, including corporate dairy farms, is being rationalised with tax credit proportional to the amount of new equity, and the later reduced to at least 70% of the total capital of the undertaking. The time limit for admissibility of credit is also being increased to 30 June 2019.

-- It is proposed to bring such Individuals and Association of Persons within the ambit of minimum tax at 1%, whose turnover in 2017 exceeds Rupees 10 million. Further, there will be no exemption from minimum tax in case of gross loss henceforth.

-- The Bill proposes to treat payments made to print and electronic media for advertisement services under Presumptive Tax. Tax will be deductible at 1.5% for filers, 12% for non-filer companies and 15% for non-filer non-corporate entities. Non-filers will have the option to file a return and claim refund of excess tax paid, if any. In addition, payments to non-residents for foreign produced commercials or advertisements on television channels are proposed to be subjected to withholding tax at 20%. The intent perhaps is to protect domestic talent.

-- Tax rate on income from services rendered and construction contracts executed outside Pakistan are being proposed to be increased from 1% to 50% of withholding rates applicable to resident persons for such services or contracts executed locally.

Withholding Taxes:

-- Advance tax at 3% of the value of the vehicle to be collected from non-filer lessees.

-- Advance tax at 4% for general insurance and at 1% on life insurance on payment of insurance premium. In the case of life insurance, the amendment will apply to policies where premium exceeds Rupees 200,000.

-- Advance tax at 5% on the value of mineral extracted by a non-filer to be collected by relevant provincial authorities.

-- 3% advance tax on turnover to be paid by non-filers on filing of provincial sales tax returns.

-- Withholding tax on dividend for non-filers increased to 20% from 17.5%.

SALES TAX

-- As in the case of Income tax, the Bill proposes to include material and equipment for construction and operation of Gwadar port, and free zone at Gwadar, imported by or supplied to specific Chinese companies operating in Gwadar, including their contractors and sub-contractors in the Sixth Schedule, Table 1, to the Sales Tax Act 1990. The intent is to provide exemption from Sales tax to the Chinese companies, including their domestic contractors and sub-contractors, for a period of 40 years. The proposal appears to be extremely generous, irrespective of the benefits that may or may not accrue to the nation because of CPEC.

-- It is proposed that Businesses in the Gwadar Free Zone be also exempted under the Sixth Schedule for all supplies within the Gwadar Free Zone for 23 years. While the basis for the period of exemptions in income taxes and sales taxes for port and free zones is curious, nonetheless, perhaps the Government should consider a reduced rate for companies operating in Gwadar, rather than total exemption.

-- The definition of "cottage industry" is being modified to include all manufacturers whose annual turnover from taxable supplies do not exceed ten million rupees; previously the turnover was restricted to five million rupees. This is a positive relief for cottage industry, however perhaps the Government should also amend the other condition relating to utility bills if the intent is to give real relief.

-- Alarmingly the Government is moving to exclude provincial taxes from the definition of input tax. This will obviously increase the overall sales tax payable by registered persons and will have an inflationary impact, beyond being detrimental for entrepreneurship. In case the provinces move in the opposite direction and start disallowing federal taxes, it will be disastrous for honest businesses. The Government needs to simplify the sales tax regime rather than increase the workload of an already overburdened judiciary.

-- The Bill proposes to empower the tax collector to recover taxes not withheld, from the withholding agent which was previously an oversight in the Act.

-- Laptops, notebooks and personal computers are being exempted from sales tax, which is indeed a step in the right direction in the information age. On the other hand, sales taxes on medium priced and smart phones is being increased by Rupees 500 per unit. Perhaps this is an attempt to tax luxury.

-- Fertilisers are currently taxed on retail prices at 17% which is now proposed to be kept at 5% of ex-factory price. This is in line with the Government''s policy to provide incentive to farmers.

FEDERAL EXCISE DUTY (FED)

-- As in the case of Sales tax and Income tax, Chinese companies and their contractors, including domestic, working in Gawadar Port and the Gawadar Free Zone are being exempted from FED for 40 years and 23 years respectively. We reiterate, that while CPEC is being deemed a game changer, tax exemptions should be considered in a long term perspective for the economy.

-- As usual bad news for smokers. The Government appears to continue with its drive to curtail smoking through increase in FED. However, the proposal this time is to increase FED in a piecemeal manner probably to water down the impact from illicit trade in cigarettes. Curiously, contrary to the strategy relating to mobile phones, FED on rich man''s cigars has not been increased.

-- The mechanism of levying tax on cement is proposed to be modified from 5% on retail price to Rupee 1 per Kilogram. This not only increases the amount of FED but also insulates the Government from downward movement in prices. This proposal will have an adverse impact on housing costs and consequently rentals. This will also adversely impact the poor man''s inflation.

-- The Bill proposes to exclude services which have been subjected to provincial levy of Sales tax from FED. This particular matter of charging of FED at the Federal level was in courts pursuant to the 18th Amendment, according to which taxation of services fall within the provincial domain. Unfortunately, the bill does not clarify whether the amendment will be effective retrospectively or not.

Analytical brief:

Issues on the state of economy 2015-16

This analytical brief on the state of Pakistan''s economy has been prepared by Social Policy and Development Centre (SPDC) in the light of Economic Survey 2015-16 and the latest available data from the Ministry of Finance (Pakistan Fiscal Operations) and the State Bank of Pakistan. This brief analysis will be followed by a detailed research report on the state of economy and evaluation of federal budget 2016-17:

GDP growth rate is 3.1% not 4.7%

Social Policy and Development Centre (SPDC) has estimated that the GDP growth rate in 2015-16 is likely to be 3.1%. This is substantially less than the GDP growth rate of 4.7% reported by the Pakistan Bureau of Statistics (PBS).

This is the third year running that PBS has exaggerated the GDP growth rate. Further, in June 2014, PBS brought down the relatively high growth rate achieved in 2011-12 from 4.4% to 3.8%. This was done to demonstrate that the GDP growth rate of 4% in 2013-14 was the highest in last six years.

According to the SPDC estimates, the growth rate in 2015-16 has been overstated in ten out of the eighteen sectors in the national economy. Almost 60% of the overstatement is in the services sector.

The alternative estimated growth rate for agriculture is negative 2%; for industry, 5.5% and for services, 4.1%, implying a GDP growth rate in 2015-16 of 3.1%1. This is consistent with the finding over last four decades that in a year when the agricultural sector declines, the GDP growth rate never exceeds 4%.

Agriculture is important for Pakistan not only because it accounts directly for 21% of the GDP but also 60% of the manufacturing is agro-based and over 40% of trading and transport is of agricultural products.

It may be that electricity generation increased by only 2%. This is unlikely to support a relatively high GDP growth rate.

Private investment fell despite an improvement in the security situation, extraordinarily low interest rates and greater access to credit.

Government has missed the target of investment set for 2015-16. The level of total fixed investment remained 13.6% of GDP against the target of 16.1%. Private investment has emerged as a major concern in this regard. Despite extraordinarily low interest rates and access to more credit, private investment has fallen from 10.2% of GDP in 2014-15 to 9.8% in 2015-16. In absolute terms, growth in private investment (at constant prices) declined to 3.3% as compared to 10.1% in fiscal year 2014-15.

The decline in private investment may be attributed to lower rate of investment both in agriculture and industry. During 2015-16, growth in investment in agriculture sector declined to only 0.2% as compared to 6.4% in 2014-15. This is in response to the sharply falling profitability of different crops, especially cotton. The negative growth in agriculture is also reflected in the sale of tractors which has declined by 39% and the fall in imports of agricultural machinery of 37%.

Growth rate in private investment in large scale manufacturing has also declined from 11.2% to 2.2% during the same period. One explanation for this is the decline in the rate of existing capacity utilisation due to the quantitative decline in exports. Another reason is the lack of expansion in the supply of electricity and gas.

There appears to be an inconsistency in that the growth in construction sector is reported at over 13% but the growth in investment in housing in only 4%.

Decline in exports is mainly due to negative quantity effect as opposed to government''s claim of negative price effect.

The government is vociferously claiming that due to low international prices of major export items, the exports of Pakistani goods have dropped by 10%. The analysis of exports reveals that quantity effect is predominant rather than price effect in FY 2016.

Major decline in export quantity is observed in sugar (47%), cotton yarn (32%), leather tanned fruits have shown modest falls in quantity of 9% and 6% respectively. However, some increase in quantity exported is observed in cotton cloth (4%) knitwear (10%) and readymade garments (4%).

Exports of SMEs have shown a significant decline in carpets (24%), leather gloves (31%) and fans (21%). This indicates that there has been a significant loss of employment in SMEs.

Significant decline in export prices is observed in basmati rice (19%), other rice (15%), cotton cloth (14%), knitwear (12%), bed wear (5%) and cement (4%).

Chinese investment is substituting for FDI from other countries instead of complementing it. The net flow of foreign direct investment (FDI) remained at only $1 billion during first 10 months of 2015-15 against the target of $3.3 billion. Major sectors attracting FDI include power, oil and gas exploration and telecommunications. China has been the main contributor of FDI during this period with a share of 54% as compared to 23% last year.

The country-wise analysis of FDI reveals that Chinese investment is substituting for the FDI from other countries such as USA, UK and UAE. The combined contribution to FDI from these countries has declined from about 43% to 14%. Some portfolio money has left Pakistan indicating some capital flight despite a relatively buoyant stock market.

The stock markets in Pakistan, particularly Karachi Stock Exchange, have performed relatively well in 2015-16. The KSE Index has gone up by 8% in 2015-16, more than most other markets in the region. However, despite the increase, almost $400 million of foreign portfolio money has left Pakistan. This indicates that external perceptions of Pakistan are not favourable. Last year, $837 million of portfolio money had entered the stock markets in the country.

Rise in foreign exchange reserves since June 2013 is due primarily to external borrowing.

Net foreign exchange reserves of the State Bank of Pakistan (SBP) have increased from $6,008 million on June 30, 2013 to $16,808 million on May 27, 2016, showing an increase of $10,800 million.

During the same period, cumulative net external borrowing is $11,102 million. The break up is of multilateral/bilateral assistance ($5,310 million), Euro/Ijara Sukuk Bond flotation ($2,908 million) and the IMF''s Extended Fund Facility ($2884 million).

Therefore, reserves have increased entirely due to external borrowing. In fact, $302 million have been used to finance the consumption of imported goods and services. There are serious concerns about future external debt sustainability.

There is risk of depletion of foreign exchange reserves by almost 54 % in the next two years.

The government seems to be comfortable with the current level of foreign exchange reserves.

However, keeping in view the external financing needs for the next couple of years, the external resource position is potentially vulnerable. The budget estimates for repayment of foreign loans and interest payment are about $6.6 billion in 2016-17.

According to SPDC estimates, current account deficit (CAD) for next year could rise to $5.5 billion. There are several factors which will increase the CAD from the present level of $2 billion. Oil prices and LNG import are expected to add $2 billion and $1 billion to the import bill respectively.

If expected negative impact of reduction in Coalition Support Fund ($1.5 billion) and positive impact of increase in exports due to restoration of cotton crop ($1 billion) is incorporated, estimated CAD may approach $5.5 billion. Thus, including external payments and CAD, external financing needs would be above $12 billion.

However, the potential financing position is not encouraging. China Safe Deposits did not materialise last year and government has excluded this item from the resource picture. It is aiming to obtain about $1 billion net from external flotation of bonds, which may not be feasible in the absence of an IMF cover.

Gross external inflow of borrowing and grants is estimated to be about $6 billion. Along with FDI, total inflow may reach $7.5 billion. This implies a shortfall of $4.5 billion, which will have to be financed through the existing foreign exchange reserves. As such, foreign exchange reserves face the risk of depletion of 27% next year and up to 54% in the next two years.

Federal non-tax revenues have declined precipitously by 25%

The federal non-tax revenues have collapsed from Rs 592 billion during first nine months of 2014-15 to Rs 445 billion during the same period of 2015-16, implying a decline of Rs 147 billion. The fall is due to a Rs 74 billion reduction in the inflow from Coalition Support Fund (CSF), Rs 45 billion due to lower profits of SBP because of decline in mark up rates, and the remaining Rs 27 billion from other sources.

The consequence is that despite the fast growth in federal tax revenues of almost 20%, overall revenues of the federal government have increased by only 10%. Next year, the short fall in CSF inflow could be as much as Rs 150 billion.

Defense expenditure has fallen in the first nine months of 2015-16 despite Zarb-e-Azb operations

The data on federal government current expenditures reveal that expenditure on defence affairs and services has, in fact, declined during July-March 2015-16 compared to same time period during last year. It was Rs 483 billion in the first nine months of 2015-16, compared to Rs 486 billion in the same months of 2014-15. The budgeted growth rate of defence expenditure in 2015-16 is 8%.

This decline is hard to explain as it happens at time when the Zarb-e-Azb operation is at its full and final stage. Has the army suddenly become more cost effective or is this the consequence of delayed releases to limit the fiscal deficit up to end-March 2016?

Cost of debt servicing has increased by Rs 105 billion due to the ''lock-in'' effect of a bigger stock of PIBs acquired at higher mark up rates

The government borrows from commercial banks and the capital market through auctioning of Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs). At the end of March 2016, the magnitude of medium- and long term PIBs stood at Rs 4.7 trillion after registering a growth of 261% since end of June 2013.

A significant feature of this borrowing is that it was made at time when interest rates were much higher than the existing rates. This is termed as the lock-in effect as government is committed to service the outstanding debt at a higher interest rate. As a result the interest payments has reached Rs 1 trillion in the first nine months of 2015-16, reflecting an increase of Rs 105 billion or over 10%, compared to the similar period a year ago. The budgeted estimates of 2015-16 assume no increase in the cost of debt servicing.

Development expenditures have shown improvement, particularly in the provinces of Balochistan and Punjab

There has been a commendable increase in consolidated (federal and provincial) development expenditure by 20% in the first nine months of 2015-16 against the same period in 2014-15. The break-up shows that federal government increased its development spending by 14%.

Among provinces, Balochistan and Punjab have done well where these expenditures increased by 27% (from Rs 22 billion to Rs 28 billion) and 48% (from Rs 148 billion to Rs 222 billion) respectively. In Khyber Pakhtunkhwa also the development expenditures increased by 24% (from Rs 45 billion to Rs 56 billion). However, Sindh showed dismal performance where development expenditure declined by 12% (from Rs 75 billion to Rs 66 billion).

Over 18 percent increase in tax revenues of FBR reflects success in mobilisation of revenues, but is due mostly to increase in indirect taxes, especially on the energy sector Tax revenue collected by FBR shows high growth of over 18% during first nine months of 2015-16, facilitated mostly by the enhancement of tax rates and holding back of refunds.

However, this increase is largely on account of growth in indirect taxes that constitute 62% of FBR taxes. While direct taxes grew at a rate of 13%, the indirect taxes went up by 22% during this period. It is important to note that the energy sector contributed almost 50% to the total revenue from indirect taxes. In particular, this has contributed to a loss of export competitiveness.

Reduction in government borrowing from scheduled banks has facilitated access of the private sector There has been a significant reduction in government''s reliance on scheduled banks for budgetary support during 2015-16. Net government borrowing from scheduled banks (July 2015 to May 2016) stood at Rs 703 billion as compared to Rs 1,093 billion during the same period in 2014-15, exhibiting a decrease of over 35%.

Reduction in government borrowings from scheduled banks has crowded in more credit to the private sector which expanded from Rs 171 billion to Rs 312 billion.

Withholding tax on all banking transactions by non-filers has led to a big decline in the increase in bank deposits and a big rise in currency in circulation.

In order to raise the tax-to-GDP ratio by increasing the number of tax payers, the government levied withholding tax at a rate of 0.6% on all transactions (of Rs 50,000 or above) through banking channels by non-filers of income tax. However, in response to dissension faced from the business community, tax rate was reduced it to 0.3% in July 2015 but subsequently was raised to 0.4% in March 2016.

This move of the government has discouraged banking transactions and promoted a culture of cash transactions, which eventually will have harmful consequences for the economy.

According the SBP data, the increase in total deposits with banks was only Rs 140 billion during Jul-May 2015-16 as compared to Rs 452 billion during Jul-May 2014-15 (less by Rs 312 billion). Simultaneously, the amount of currency in circulation increased by Rs 611 billion during Jul-May 2015-16 against Rs 336 billion during same period last year (up by Rs 275 billion).

Budget deficit up to March 2016 is understated by Rs 200 billion

The budget deficit is equal to the total borrowings, domestic and external. Domestic borrowing is derived as the change in domestic debt.

During the period, July 2015 to March 2016, Ministry of Finance reports the increase in domestic debt of Rs 1,007 billion. As opposed to this, SBP estimates the rise in domestic debt at Rs 1,209 billion. Therefore, the Ministry has understated the deficit of the federal government by over Rs 200 billion.

As such, the federal deficit has reached 4.8% of the GDP by March 2016. During the last quarter of a year during the last five years, the average deficit is almost 2% of the GDP. Consequently, the federal deficit may exceed 6.5% of the GDP by end June 2016, somewhat above the level of last year.

Public debt as percent of GDP has increased in the first nine months of 2015-16 to 66 %

Pakistan''s debt-to-GDP ratio was 63.2 percent at the end of 2014-15, which has increased to 66 percent at the end of March 2015-16, according to the SBP. Almost three percentage point increase in the debt-to-GDP ratio is an alarming development.

The trend of debt servicing as percentage of net federal revenue receipts during last few years reveals that the public debt is mounting to unsustainable level. This ratio increased from 53% in 2007-8 to 62% in 2014-15 and then to 73% in the first nine months of 2015-16, which indicates that only 27% of the net federal revenue (NFR) is left for all other expenditures.

The situation becomes even worse if defence expenditures are added. The combined expenditure on debt servicing and defence as percentage of NFR was 82% in 2007-8 and 94% in 2014-15. It has now risen to 105%. It implies that government has to borrow money even to pay salaries, subsidies and so on.

Ideally, a government should only borrow for development. Federal development expenditure as percentage of its fiscal deficit is an indicator that reflects the extent of borrowing utilised for financing the development spending. This ratio was 41% in 2013-14 and has now declined to only 26% in 2015-16 (first nine months) implying that 78% of the borrowing is being used for consumption purposes instead of investment in development projects.

This again raises serious concerns about the debt servicing capacity of the government in future.

Poverty is increasing not falling

The Finance Minister in his Press Conference on June 2, 2016 claimed that incidence of poverty is declining in Pakistan.

The estimates given in Economic Survey 2015-16 also indicate that poverty has fallen drastically from 44% in 2007-08 to 29.5% in 2013-14.

However, performance of several indicators that affect poverty incidence does not support this claim. These include deterioration in housing conditions, increase in unemployment, fall in real wages, relative increase in food prices, and decline in food consumption leading to higher levels of malnutrition.

For instance, the proportion of housing units with one room increased from 23% to 26% and further went up to 28% in 2014-15, reflecting deterioration in housing conditions. Also, the proportion of housing units with piped water facility declined from 31% 2008-09 to 30% in 2012-13 and to 27% in 2014-15. Further, during 2011-12 to 2013-14, growth in housing rents was 26% against 17% growth in the overall CPI. This indicates that housing rents in this period increased in real terms.

According to Pakistan Labour Force Survey the unemployment rate increased from 5.2% in 2007-08 to 6.2% in 2012-13 and then declined to 5.9% in 2014-15. However, after incorporating the effect of ''discouraged workers'', the estimated unemployment rate increases to 10% currently.

Food inflation during 2007-08 and 2012-13 and during 2013-14 and 2015-16 remained higher than overall inflation. This gap increased substantially during 2014-16 with food inflation at 14%, and overall CPI at 7 %.

Another worrisome indicator is that per capita consumption of some important basic food items by the population in two lower quintiles has declined. Between 2007-08 and 2013-14, per capita consumption of atta and milk has fallen.

These fundamental indicators are among the crucial determinants of poverty and deterioration in their performance certainly contributes in increasing the incidence of poverty. As such, SPDC is of the view that poverty is rising not falling.

Source: Business Recorder

Comments are closed on this story.