Trump taps ex-Fed insider Warsh to lead world’s top central bank

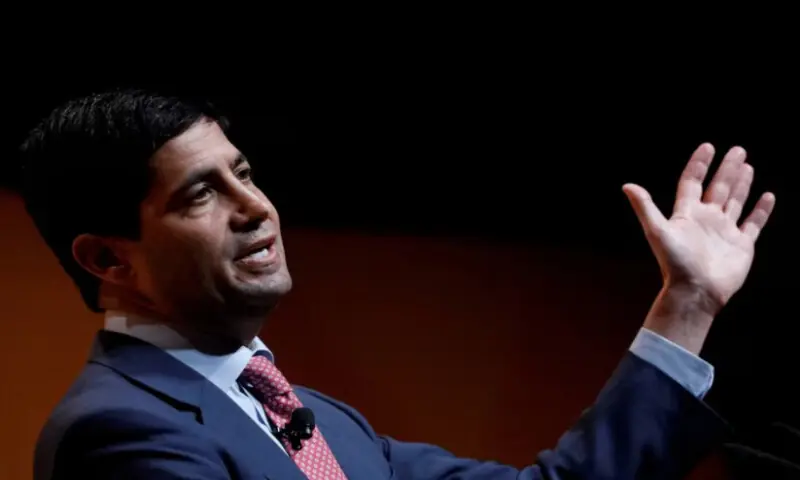

5 min readPresident Donald Trump on Friday chose former Federal Reserve Governor Kevin Warsh to head the U.S. central bank when Jerome Powell’s leadership term ends in May, giving a frequent Fed critic a chance to put his idea of monetary policy “regime change” into practice at a moment when the White House has pushed for more control over the setting of interest rates.

“I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is ’central casting, and he will never let you down,” Trump said in announcing his latest move to put his stamp on a Fed he persistently criticises for not caving to his demands for deep reductions in borrowing costs.

Global stocks edged higher while the dollar rose and the price of gold plunged after Trump announced his pick of Warsh, who markets perceive as someone who would support lower rates but who would stop well short of the more aggressive easing associated with some of the other potential nominees.

Trump announced the nomination, which requires confirmation by the U.S. Senate, in a post on social media. No public events have been listed on the president’s schedule for Friday involving the Fed.

How quickly Warsh’s nomination gets through a closely divided Senate is unclear. One key Republican on the Senate Banking Committee, which will be the first body to review the nomination, already has repeated an earlier vow not to support any nominee to the Fed as long as Trump’s Department of Justice continues with a criminal probe of Powell that became public earlier this month.

“My position has not changed: I will oppose the confirmation of any Federal Reserve nominee, including for the position of Chairman, until the DOJ’s inquiry into Chairman Powell is fully and transparently resolved,” Senator Thom Tillis of North Carolina said in a post on X.

With Republicans holding a 13-11 majority on the committee and all Democrats likely to oppose Warsh’s nomination, Tillis could deadlock the panel if he maintains his current position.

Other Republican senators on the panel, however, said Warsh would be good for Fed independence.

“No one is better suited to steer the Fed and refocus our central bank on its core statutory mandate,” Senator Bill Hagerty said in a social media post.

The Fed has long been seen as a stabilising force in global financial markets due in no small part to its perceived independence from politics, and Trump’s escalating efforts to test that independence will be a key issue through the approval process.

It has also opened the door to the possibility that Powell, who called the criminal probe a pretext to pressure the Fed into setting monetary policy as the president wishes, may opt to stay on at the Fed as a governor even after his term as central bank chief is up in a bid to safeguard it from political capture.

The nomination caps a months-long process that often resembled a public audition as Warsh, White House economic adviser Kevin Hassett and other top contenders - including sitting Fed Governor Christopher Waller and Wall Street insider Rick Rieder — appeared regularly on television to tout their credentials and showcase their thoughts about the economy and Fed policy.

Trump in August named White House economic adviser Stephen Miran to fill a vacant governor’s seat on the Fed, where he has become a leading proponent of the aggressive rate cuts that Trump has long sought. Trump has also tried to force out Fed Governor Lisa Cook in a battle now before the Supreme Court that, if successful, would mark the first time a president has ever fired a U.S. central bank policymaker.

WARSH FAVORS BROAD OVERHAUL OF CENTRAL BANK

While Warsh, 55, is no White House insider, he has been a confidant of the president and a guest at the president’s Florida estate, and looks poised to push many of Trump’s priorities as a “shadow” Fed chief until Powell’s tenure in the top job ends in mid-May.

A lawyer and distinguished visiting fellow in economics at Stanford University’s Hoover Institution, Warsh has said he believes the president is right to press the Fed for steep rate cuts, and has criticised the central bank for underestimating the inflation-busting potential of productivity growth supercharged by artificial intelligence.

He has also called for a broad overhaul of the central bank that would slim its balance sheet and ease bank regulations.

Warsh was nearly named to the job in Trump’s first term before being passed over for Powell, and since then has kept a steady public profile through speeches and essays that have taken Powell and his colleagues to task for their management of the Fed’s balance sheet, interest rates and other actions.

He will be responsible for an institution he has said should scale back its footprint in the economy and change the way it manages monetary policy.

It is not clear how the pick may affect the trajectory of rates in the short term. The Fed’s three rate cuts in 2025 brought its benchmark interest rate to the 3.50%-3.75% range. Earlier this week, citing stronger growth and a stabilizing labor market, it left rates on hold and signalled a pause ahead; markets for now don’t expect another rate cut until the June 16-17 meeting, when Powell’s successor is expected to be in place.

With a background on Wall Street, including as a partner in the office managing the wealth of investing giant Stanley Druckenmiller, and family ties to major Trump supporter Ron Lauder, Warsh will be under an intense spotlight to prove his independence from the president.

As a Fed governor from 2006 to 2011, Warsh’s familiarity with Wall Street executives and investors made him a chief liaison to the financial community for then-Fed Chair Ben Bernanke during the 2007-2009 financial crisis.

Though he did not dissent against the massive bond purchases Bernanke used to nurse the economy out of what proved to be a long downturn, he was concerned they would stoke inflation and eventually resigned. Warsh’s inflation concerns proved misplaced, but the large size of the Fed’s balance sheet and the role it plays in managing interest rates remain a concern.

He now argues that shrinking the Fed’s big balance sheet would allow it to “redeploy” excess liquidity in financial markets to the real economy by lowering the central bank’s policy rate.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.