Rising oil prices push Pakistan's rupee lower against US dollar

2 min readRising oil prices pushed Pakistan’s rupee lower against the US dollar, as the currency registered a depreciation of 0.12% in the inter-bank market on Wednesday.

As per the State Bank of Pakistan (SBP), the rupee closed at 177.62 after a day-on-day depreciation of 21 paisas or 0.12%. The local currency had on Tuesday reversed its negative trajectory and recorded an appreciation of 0.03%.

The latest decline comes as oil prices surged on Wednesday as supply disruption fears mounted following hefty sanctions on Russian banks amid the intensifying Ukraine conflict, while traders scrambled to seek alternative oil sources in an already tight market.

Brent crude futures rose by as much as $8 and touched as high as $113.02 a barrel, the highest since June 2014, before easing to $111.75.

US West Texas Intermediate (WTI) crude futures were up $7.24, or 7%, to $110.67 a barrel, after earlier hitting the highest since August 2013.

“This is definitely a challenge for the country facing a widening current account deficit,” Saad Hashmey, Executive Director at BMA Capital, told Business Recorder.

Hashmey expressed concern that amid rising commodity prices, Pakistan’s import of petroleum products, which already stands above $9 billion in the ongoing fiscal year, could go over $20 billion by the end of FY22.

“There is a concern on how this huge import bill would be financed, which is leading to volatility in the market, and affecting sentiment in both money and equity markets,” he added.

Meanwhile, Zafar Paracha, General Secretary at Exchange Companies Association of Pakistan (ECAP), told Business Recorder that the ongoing Ukraine-Russia conflict is driving sentiment globally, "which is being reflected locally as well".

"Due to this, rupee will remain under pressure in the near future," said Paracha.

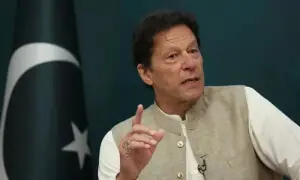

Meanwhile, on Prime Minister Imran Khan's recently-announced package, Paracha said it could cause a further surge in the import bill.

"Overall, it is a good package. However, it will lead to an increased uptake of machinery purchase, and this would drive the import bill further."

Meanwhile, another expert on condition of anonymity told the scribe that there are concerns regarding the package. "A reduction in oil prices would push up demand, and this could add to the rising current account deficit."

The country’s current account deficit has already crossed the $11 billion mark in the first seven months of this fiscal year (FY22), mainly due to a higher import bill.

“How would the government manage the external account in face of rising commodity prices is a concern,” said the expert.

This article was first published in Business Recorder on March 02, 2022.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.