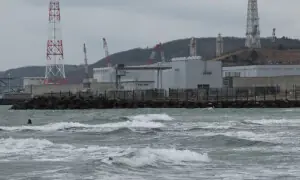

Japan's land prices drop for first time in three years as coronavirus hurts demand

TOKYO (Reuters) - Japanese land prices have fallen for the first time in three years, marking an average decline of 0.6% nationwide after the coronavirus pandemic weakened demand, a government survey found.

Prior to the pandemic, land prices had been making a steady recovery with demand for hotels and other commercial properties particularly strong due to robust tourism and ahead of the now delayed Tokyo Olympics. An increase in demand for offices from companies had also helped.

But commercial land prices slipped 0.3% in the year to July 1, their first decline in five years, the land ministry’s annual survey found.

“Land prices related to hotels and shops showed relatively big changes but price changes for many other types of areas were smaller,” a land ministry official said.

Residential land prices, which have been declining since 1992 in the wake of the bursting of Japan’s bubble economy, accelerated their pace of falls, dropping 0.7% after a 0.1% dip in the previous year.

Land prices are among data closely watched by the Bank of Japan to monitor how its super-loose monetary policy is affecting the economy and asset prices.

The ministry surveyed about 21,500 locations nationwide.

Comments are closed on this story.